In 2025, the US FDA approved 45 new drugs, including 34 New Chemical Entities (NCEs) and 11 New Biological Entities (NBEs), highlighting a strong and diverse innovation pipeline.

Oncology continues to lead approvals, but significant momentum is also seen in cardiovascular, metabolic, respiratory, immunology, and anti-infective therapies, signaling broad-based investment across therapeutic areas.

Several newly approved NCEs show blockbuster-level commercial potential, with projected multi-billion-dollar sales by 2031. Importantly, the NCE-1 dates beginning in 2029 mark critical early windows for ANDA and Para IV planning, comparator sourcing, and strategic development decisions.

For pharmaceutical and biotech teams, tracking these approvals early enables smarter portfolio prioritization, reduced sourcing risk, and better alignment with regulatory and market-access timelines. Together, these approvals highlight where innovation, investment, and future commercial value are heading.

This blog brings together essential approval and market data in a single view, helping development teams and market access leaders make informed decisions and plan Para IV filing with confidence.

List of FDA-Approved Drugs 2025

| Brand name | Molecule | NCE-1 Date | Therapeutic Category | Projected Sales by 2031 |

| Grafapex | Treosulfan | 21/01/2029 | Anticancer | $ 100 Million |

| Journavx | Suzetrigine | 30/01/2029 | Analgesic | $ 2.5 Billion |

| Gomekli | Mirdametinib | 11/02/2029 | Anticancer | $ 969 Million |

| Romvimza | Vimseltinib | 14/02/2029 | Anticancer | $ 209 Million |

| Blujepa | Gepotidacin | 25/03/2029 | Antibiotic | $ 567 Million |

| Qfitlia | Fitusiran | 28/03/2029 | Hemostatic Agents | $ 660 Million |

| Vanrafia | Atrasentan | 02/04/2029 | Nephroprotective | $ 781 Million |

| Avmapki Fakzynja Co-Pack | Avutometinib And Defactinib | 08/05/2029 | Anticancer | $ 676 Million |

| Tryptyr | Acoltremon | 28/05/2029 | Ophthalmic | $ 370 Million by 2028 |

| Ibtrozi | Taletrectinib | 11/06/2029 | Anticancer | $ 471 Million |

| Zegfrovy | Sunvozertinib | 02/07/2029 | Anticancer | $ 356 Million |

| Ekterly | Sebetralstat | 03/07/2029 | Hereditary Angioedema Agents | $ 590 Million |

| Anzupgo | Delgocitinib | 23/07/2029 | Dermatologic | $ 234 Million |

| Sephience | Sepiapterin | 28/07/2029 | Antimetabolic Disorder | $ 516 Million |

| Vizz | Aceclidine | 31/07/2029 | Antiglaucoma Agents | $ 428 Million |

| Modeyso | Dordaviprone | 06/08/2029 | Anticancer | $ 364 Million |

| Hernexeos | Zongertinib | 08/08/2029 | Anticancer | $ 52 Million |

| Brinsupri | Brensocatib | 12/08/2029 | Respiratory Agents | $ 3.8 Billion |

| Dawnzera | Donidalorsen | 21/08/2029 | Hereditary Angioedema Agents | $ 470 Million |

| Wayrilz | Rilzabrutinib | 29/08/2029 | Immunomodulators | $ 677 Million |

| Forzinity | Elamipretide | 19/09/2029 | Mitochondrial Dysfunction Agent | NA |

| Inluriyo | Imlunestrant | 25/09/2029 | Anticancer | $ 630 Million |

| Palsonify | Paltusotine | 25/09/2029 | Hormonal Therapy | $ 621 Million |

| Rhapsido | Remibrutinib | 30/09/2029 | Immunomodulators | $ 1.9 Billion |

| Jascayd | Nerandomilast | 07/10/2029 | Antifibrotic | $ 162 Million by 2029 |

| Lynkuet | Elinzanetant | 24/10/2029 | Anti-Menopausal | $ 1.49 Billion |

| Kygevvi | Doxecitine And Doxribtimine | 03/11/2029 | Antimetabolic Disorder Agent | $ 65 Million |

| Komzifti | Ziftomenib | 13/11/2029 | Anticancer | $ 1.37 Billion |

| Redemplo | Plozasiran | 18/11/2029 | Antihyperlipidemic | $ 2.1 Billion |

| Hyrnuo | Sevabertinib | 19/11/2029 | Anticancer | $ 91 Million |

| Nuzolvence | Zoliflodacin | 12/12/2029 | Antibiotic | $ 114 Million |

| Cardamyst | Etripamil | 12/12/2029 | Antiarrhythmic Agent | $ 365 Million |

| Myqorzo | Aficamten | 19/12/2029 | Cardiovascular Agent | $ 2.9 Billion |

| Nereus | Tradipitant | 30/12/2029 | NA | NA |

Why 2025 FDA NCE Approvals Matter

Each NCE approval represents:

- Years of clinical development

- A defined regulatory standard fulfillment

- Specific market exclusivity timeline

For pharmaceutical companies developing generics and biosimilars, these approvals signal future opportunities.

Understanding them early helps you:

- Plan comparator sourcing

- Track NCE-1 dates

- Prepare ANDA or follow-on strategies

- Anticipate clinical trial supply complexity

Therapeutic Diversity Across 2025 NCEs

The 2025 NCE list is not dominated by a single therapy area.

Instead, value is spread across:

- Oncology

- Cardiovascular diseases

- Respiratory disorders

- Immunology

- Antiinfectives

- Rare and metabolic conditions

This diversity shows that innovation is widespread across therapeutic areas, not concentrated in a single segment.

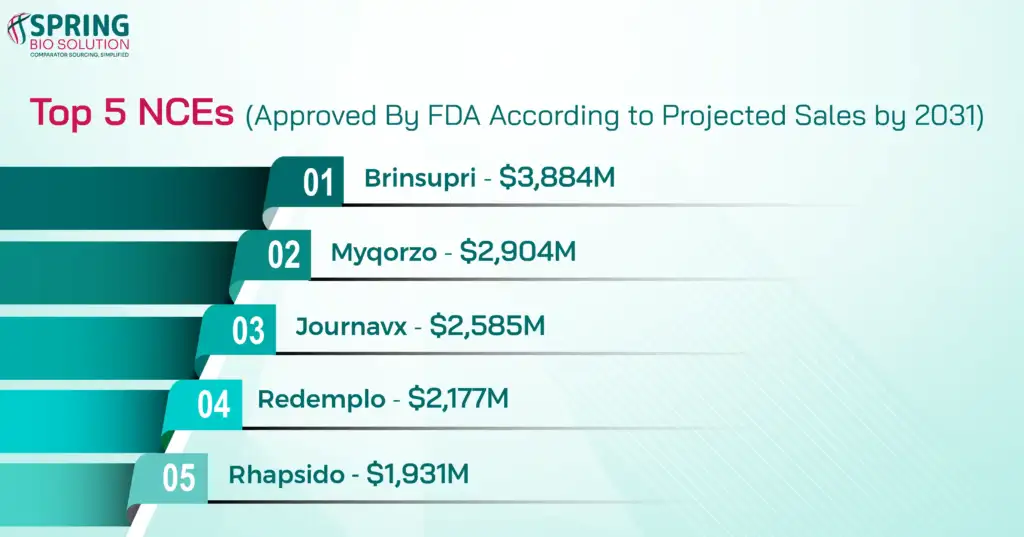

Top 5 Blockbuster NCEs Approved by FDA in 2025 by Projected Sales (by 2031)

Some molecules stand out for their strong commercial potential. Have a look at the top 5 NCEs with the Highest Sales Projections:

These molecules alone highlight where long-term market value is concentrating.

Rising Importance of Cardiovascular and Metabolic Therapies

Cardiovascular and lipid-lowering agents show strong commercial promise.

Notable examples of such drugs are:

- Myqorzo (Aficamten) Cardiovascular

- Redemplo (Plozasiran) – Antihyperlipidemic

Oncology Continues to Lead, But Not Alone

A large share of 2025’s approved NCEs fall into the anticancer therapy category, including:

- Gomekli

- Romvimza

- Hernexeos

- Ibtrozi

- Komzifti

Most are oral solid dosage forms. At the same time, non-oncology areas are also gaining momentum.

Excluding anticancer, cardiovascular, and metabolic therapies, the FDA-approved 2025 NCEs span therapeutic categories including Analgesics, antibiotics, respiratory agents, immunomodulators, hemostatic agents, nephroprotective agents, ophthalmic and antiglaucoma agents, dermatologic agents, hereditary angioedema agents, antifibrotic agents, hormonal and anti-menopausal therapies, mitochondrial dysfunction agents, and antiarrhythmic agents.

Why NCE-1 Dates Are Critical

The NCE-1 date marks the 1-year period prior to the end of the 5-year exclusivity period.

It defines:

- The earliest ANDA filing opportunity

- Patent challenge timelines

- Strategic sourcing windows

Tracking NCE-1 dates early gives development teams a competitive edge.

What This Means for Clinical Development Teams

With 34 NCEs approved in the year 2025:

- Comparator drug demand will increase

- Supply chains will tighten

- Regulatory scrutiny will intensify

Sponsors who plan early reduce risk later.

This is especially true for:

- Multiregional trials

- Rare disease programs

- Fast-moving respiratory and cardiovascular pipelines

How Spring Bio Solution Supports You

At Spring Bio Solution, we help sponsors:

- Anticipate sourcing challenges early

- Secure compliant comparator drug supplies

- Align sourcing strategies with development timelines

Our expertise spans:

- Global comparator sourcing

- Regulatory-compliant RLD access

- Strategic clinical trial supply management

Explore All NCE & NBE Approvals in One Place

To track FDA-approved NCEs and NBEs with clarity, explore the NCE Grid.

It helps you:

- Monitor approvals

- Track NCE-1 dates

- Identify high-value molecules early

Early insight leads to better decisions. And better decisions start with the right data, just one click away.

Let’s Connect

If you are evaluating any of these molecules for clinical development, we would be happy to support you. Contact Spring Bio Solution for your comparator sourcing needs.