In 2025, the US FDA approved 11 New Biological Entities (NBEs), representing a significant milestone in biologics innovation. The NBE landscape showcases the power of biologics across high-value therapeutic areas, with several molecules projected to reach multi-billion-dollar sales by 2031. Oncology dominates the NBE approvals, but immunology, respiratory, cardiovascular (lipid disorders), and rare disease therapies also feature prominently.

The Data Exclusivity Expiry dates beginning in 2029 mark critical windows for biosimilar development planning, comparator sourcing, and strategic market entry decisions. For pharmaceutical and biotech teams, tracking these biologics approvals early enables smarter portfolio prioritization, reduced sourcing complexity, and better alignment with regulatory timelines and competitive landscapes.

These approvals reveal where the future of biologics innovation, investment, and commercial value is heading.

This blog will help development teams and market access leaders make informed biosimilar development decisions with confidence.

List of FDA-Approved New Biological Entities (NBEs) in 2025

| Brand Name | Molecule | Data Exclusivity Expiry | Therapeutic Category | Projected Sales by 2031 |

| Datroway | Datopotamab Deruxtecan-Dlnk | 17/01/2029 | Anticancer | $4.5 Billion |

| Penpulimab-Kcqx | Penpulimab-Kcqx | 23/04/2029 | Anticancer | $132 Million |

| Imaavy | Nipocalimab-Aahu | 29/04/2029 | Immunomodulators | $3.4 Billion |

| Emrelis | Telisotuzumab Vedotin-Tllv | 14/05/2029 | Anticancer | $876 Million |

| Enflonsia | Clesrovimab-Cfor | 09/06/2029 | Immunomodulators | $1.04 Billion |

| Andembry | Garadacimab-Gxii | 16/06/2029 | Hereditary Angioedema Agents | $567 Million |

| Lynozyfic | Linvoseltamab-Gcpt | 02/07/2029 | Anticancer | $662 Million |

| Voyxact | Sibeprenlimab-Szsi | 25/11/2029 | Immunomodulator | $1.9 Billion |

| Lerochol | Lerodalcibep-Liga | 12/12/2029 | Antihyperlipidemic | NA |

| Exdensur | Depemokimab-Ulaa | 16/12/2029 | Respiratory Agent | $2.1 Billion |

| Yartemlea | Narsoplimab-Wuug | 23/12/2029 | NA | NA |

Why 2025 FDA NBE Approvals Matter

Each NBE approval represents:

- Years of biologics development through complex manufacturing processes

- Defined regulatory pathways, including stringent quality requirements

- 12-year market exclusivity

- Specific biosimilar opportunity windows

For pharmaceutical companies developing biosimilars, these approvals signal future high-value opportunities.

- Understanding them early helps you:

- Plan biologics comparator sourcing strategies

- Track data exclusivity expiry dates

- Prepare biosimilar development strategies

- Anticipate clinical trial supply complexity for large molecules

Therapeutic Diversity Across 2025 NBEs

While the 2025 NBE list is smaller than the NCE list, it demonstrates concentrated innovation in high-impact areas:

- Oncology

- Immunomodulators

- Respiratory agents

- Cardiovascular/Metabolic

- Hereditary Angioedema

This distribution reflects where biologics innovation delivers the greatest clinical differentiation and commercial value.

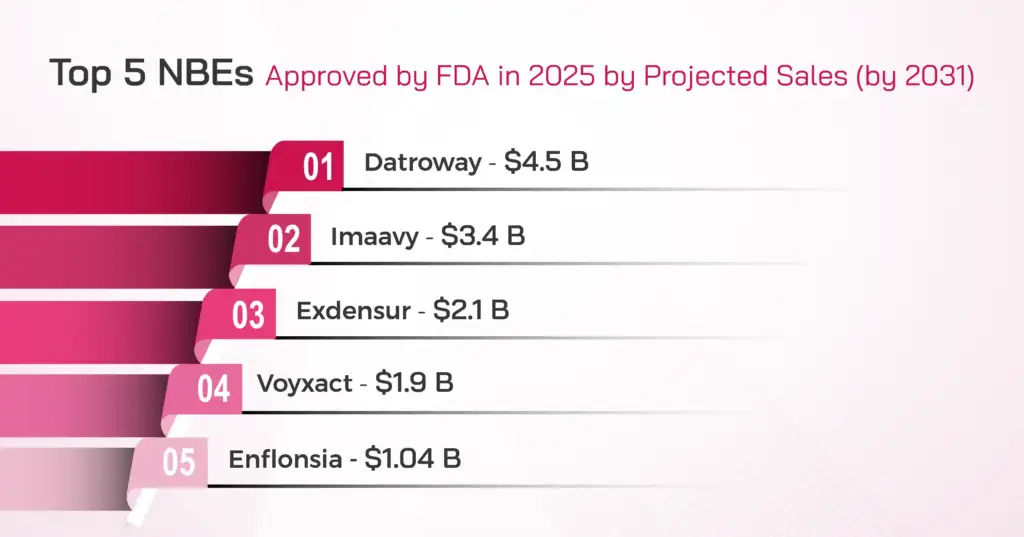

Top 5 Blockbuster NBEs Approved by FDA in 2025 by Projected Sales (by 2031)

These five molecules alone represent the lion’s share of commercial value among 2025 NBE approvals, highlighting where biosimilar developers should focus their long-term strategic planning.

Oncology Dominates NBE Approvals

2025 NBE approvals are anticancer biologics, including:

- Datroway

- Penpulimab-Kcqx

- Emrelis

- Lynozyfic

These products reflect the ongoing evolution of precision oncology and the premium that payers place on targeted cancer therapies.

Immunomodulators: A Major Growth Area

Immunomodulator biologics represent a significant number of NBE approvals and include three blockbuster-level products:

- Imaavy (Nipocalimab-Aahu) – Projected $3.4B sales

- Voyxact (Sibeprenlimab-Szsi) – Projected $1.9B sales

- Enflonsia (Clesrovimab-Cfor) – Projected $1.04B sales

Combined market potential: $6.34 Billion

This category’s strength reflects the growing understanding of immune system modulation across autoimmune diseases, inflammatory conditions, and beyond.

Respiratory Biologics with Blockbuster Potential

Exdensur (Depemokimab-Ulaa) stands out as the sole respiratory agent approval, yet it carries a $2.1 billion sales projection by 2031.

This highlights the high unmet need in severe asthma and other chronic respiratory conditions, where biologics offer targeted mechanisms of action unavailable to small molecules.

Why Data Exclusivity Expiry Dates Are Critical

Unlike NCEs with 5-year exclusivity, NBEs benefit from 12 years of market exclusivity under the Biologics Price Competition and Innovation Act (BPCIA).

The Data Exclusivity Expiry dates starting in 2029 define:

- The earliest biosimilar application submission opportunity

- Patent challenge and interchangeability pathways under 351(k)

- Strategic reference product sourcing windows

- Analytical and clinical comparability study timelines

Tracking these dates early gives biosimilar development teams a competitive edge in planning manufacturing, regulatory strategy, and market entry.

What This Means for Biosimilar Development Teams

With 11 high-value NBEs approved in 2025:

- Reference product demand will surge as biosimilar developers initiate programs

- Supply chains for biologics comparators are more complex due to the cold chain, stability, and batch variability

- Regulatory expectations are stringent – analytical similarity, clinical immunogenicity, and manufacturing consistency are critical

- Sponsors who plan early reduce risk and accelerate timelines

This is especially important for:

- Multi-regional biosimilar trials

- Oncology biologics requiring extensive analytical characterization

- Immunomodulator biologics with complex mechanisms of action

- First-wave biosimilar developers seeking competitive advantage

How Spring Bio Solution Supports Biosimilar Development

At Spring Bio Solution, we specialize in helping biosimilar sponsors navigate the complexities of biologics comparator sourcing:

- Anticipate reference product sourcing challenges across global markets

- Secure compliant biologics comparators with cold chain integrity

- Align sourcing strategies with biosimilar development timelines

Our expertise spans:

- Global biologics comparator sourcing

- Compliant Reference Listed Drug (RLD) access

- Regulatory-compliant supply for 351(k) biosimilar pathways

Explore All NCE & NBE Approvals in One Place

To track both NCEs and NBEs with clarity, explore the NCE Grid.

It helps you:

- Monitor all new approvals

- Track NCE-1 dates and data exclusivity expiry dates

- Identify high-value molecules early

- Compare therapeutic area trends across modalities

Early insight leads to better decisions. And better decisions start with the right data, just one click away.

Let’s Connect

If you are evaluating any of these biologics for biosimilar development, we would be happy to support you.

Contact Spring Bio Solution now.

Key Takeaways

- 11 NBEs approved in 2025, representing $12.94B+ in projected sales from the top 5 alone

- Oncology and immunomodulators dominate, with ADCs showing particularly strong commercial potential

- Data exclusivity expiry dates in 2029 create critical biosimilar planning windows